Cascades offers medical coverage for employees, spouses, and children, including coverage for prescription drugs and certain free preventive care services. Please remember to get your free annual wellness exam every year

Medical Insurance

Dental Insurance

Vision Insurance

Disability Insurance

Medical Coverage

- Complete your HRA

What can you find here?

- Locate a provider

- Access telemedicine

- Review the status of claims

- Download MyCigna app

- Review your HRA

Dependents Coverage

If you want to include your dependents (spouses, children up to age 26 or domestic partners) you need to provide:

- SSN

- Marriage Certificate

- Birth Certificate (for each dependent children)

- Domestic Partner: In addition to the domestic partner affidavit you will need to submit three (3) documents from the verification of domestic partnership form – One (1) document from Proof F and Two (2) documents from Proof G

Pharmacy Benefit Manager

Mail Order

- MXP Pharmacy – Amarillo, TX

- 90-day maintenance medications

- Delivered to member's home

- How to enroll:

- Maxorplus.com to setup/activate an account

- New script sent to MXP for 90 days with refills

- Member Services for any questions or issues.

- Available 24/7

- Phone number listed on the back of CIGNA card

Specialty

- Maxor Specialty

- Specialty injectables/ biologics

- Chronic illness with special handling or case management

- High-cost medications

- No enrollment needed

- Maxor Specialty case management reaches out to the patient when warranted

Prior Authorizations

- Maxor Standard PA list

- High Cost medications

- Step Therapy rules

- Non-formulary medications

- Process:

- Pharmacy, doctor, or patient can call for PA

- MaxorPlus requests info from a doctor (via an electronic form)

- Dr. provides information

- Maxor Clinical Pharmacist reviews approves/ denies

- Appeals – independent review organization

Formulary

- Formularies serve as a guide to assist patients and doctors with the most cost-effective drug options.

- Preferred Brands

- Generic drugs

- Non Preferred Brands

- Exclusions and alternatives

- Bi-annual updates

The MaxOr+ member page includes information about the member portal, a member portal login link, the phone number to the Member Services line, mail order enrollment forms, and member reimbursement forms, to name a few.

Dental Coverage

Vision Coverage

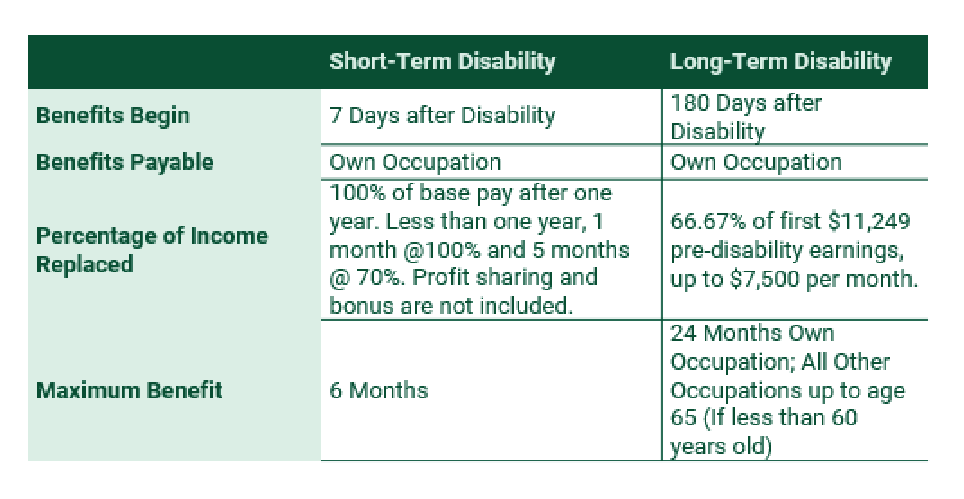

Life, Short-Term and Long Term Disability Coverage

Check with HR to verify eligibility for short and/or long-term disability

MetLife Forms

Based on your enrollment, a Statement of Health is required to complete your request for group insurance coverage. Below are instructions for Completing the Statement of Health Form and the beneficiary form for your life insurance

Flexible Spending Account (FSA)

Flexible Spending Accounts (FSAs) are designed to save you money on your taxes. They work in a similar way to a savings account. Each pay period, funds are deducted from your pay on a pre-tax basis and are deposited to your Health Care and/or Dependent Care FSA. You then use your funds to pay for eligible health care or dependent care expenses.

Eligible Expenses

Most medical, dental, and vision care expenses that are not covered by your health plan (such as copayments, coinsurance, deductibles, eyeglasses and doctor-prescribed over-the-counter medications)

For more information go to https://www.healthequity.com/oetoolkit

Health Savings Account (HSA)

An HSA is a tax-advantaged* personal savings account designed to complement a qualified high-deductible health plan (HDHP). You can use an HSA to pay for medical, prescription drugs, dental, vision, and other qualified expenses now or later in life. The funds can even be invested, making it a great addition to your retirement portfolio.

Eligible Expenses

You can use your HSA to pay for eligible healthcare expenses, such as Vision, Dental, Certain medical supplies, Copays, Deductibles, and Coinsurance