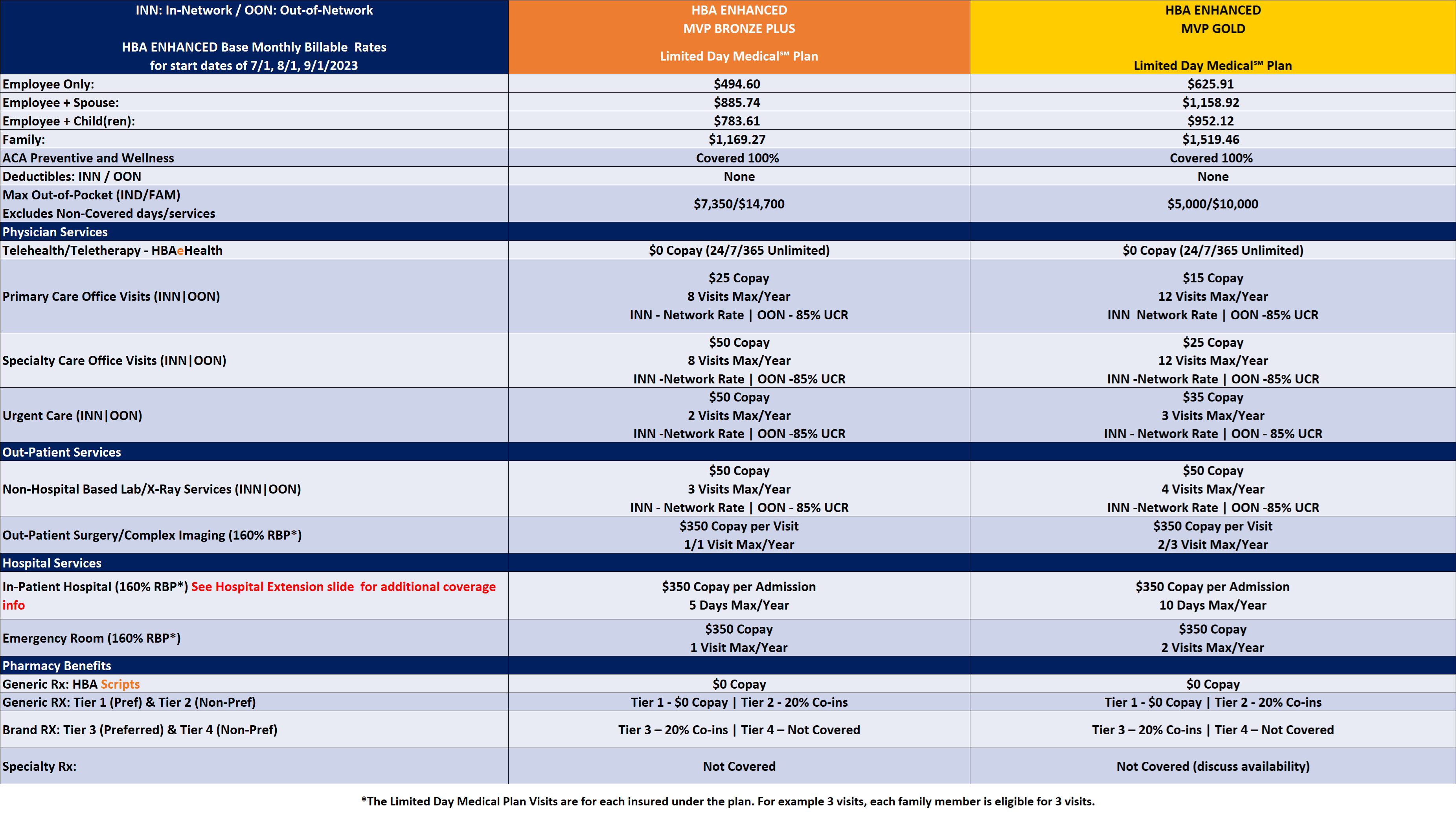

Plan Details

Plan Limitations

- The Health Benefit Alliance program manages the efficient and cost effective delivery of healthcare through pre authorization requirements for certain services and prescriptions, formulary management and other cost containment protocols as outlined in the Schedules of Benefits.

- MVP Limited Day Medical℠ Plans provide comprehensive and affordable health coverage for HBA participants. To ensure affordability, HBA plans contain limits that differ from other “traditional” carrier plans.

Day limits for coverages

Chemotherapy and Radiation excluded in BRONZE+ & GOLD plans

Kidney Dialysis excluded in BRONZE+ & GOLD plans

Specialty Rx excluded in BRONZE+ & GOLD plans

Note that all of the above are covered in the MVP plan

Underwriting Guidelines

Minimum Participation Requirements

- Minimum Employer Size: Two (2) Eligible Employees, both or which must actively enroll for coverage (eligible groups must be valid employers and have at least one common-law employee participating all times)

- 25% of eligible employees if MVP Ultra Plan(s) are not offered

If MVP Ultra Plan(s) are offered:

"Qualified Waivers"

Employees with health insurance coverage elsewhere are excluded from the minimum participation calculation

- Group health Questionnaire (GHQ)

- No Minimum Employer Contribution Requirement

- Eligible Employees

- HBA Plans available to full-time, part-time and seasonal employees

- MVP Ultra Plan(s) or PPO must be accompanied by at least one (1) Limited Day Medical plan

- 50% of eligible employees must enroll in an HBA plan offering

Dental and Vision

Helps provide the peace of mind that comes from knowing you’ll have help with both routine and unexpected expenses

- Dental and vision coverage are important in ways that go beyond the obvious. Aflac’s group dental and vision insurance plans don’t skimp on the basics, of course. They work similarly to health insurance, paying benefits to providers when insureds receive care such as dental exams and cleanings, eye exams, and corrective lenses. They also pay benefits for procedures such as dental crowns and cavity care.

Highlights

- Deductible that decreases over time.

- Calendar year 1: $50/person (3 per family).

- Calendar year 2: $25/person (3 per family).

- Calendar year 3+: No deductible.

- Maximum carryover benefit.

- No waiting period for any services.

- Dental implants covered.

- Dental accidental injury benefit.

- PPO and MAC options are available.

- Orthodontia benefits available.

- Member services in and out of network (Davis Vision)

- Eye exams/contact lens evaluation.

- Eyeglass lenses – single, bifocal, trifocal or lenticular lenses.

- Progressive lenses.

- Polarized and high-index lenses.

- Scratch resistant and ultraviolet coating.

- Frames.

- Contact lenses.