Unique offer for QSR Enterprises Members!

QSR Enterprises is offering valuable benefits offer, through MassMutual and Aflac with the option to set up payment through your paycheck using direct deposit.

Aflac benefits are paid directly to you (unless otherwise assigned) to help pay for expenses that major medical plans do not cover, while also helping to replace lost income and provide dollars to assist with everyday living expenses.

With MassMutual's whole life insurance, unlike term, you have guarantees of level premiums, cash value, and death benefit. Participating whole life insurance is eligible to earn dividends, which can be used to increase the death benefit and the cash value of the policy.

Products are Guaranteed Issue

No Pre-Existing Condition Limitations

Coverage is Portable*

*With certain stipulations

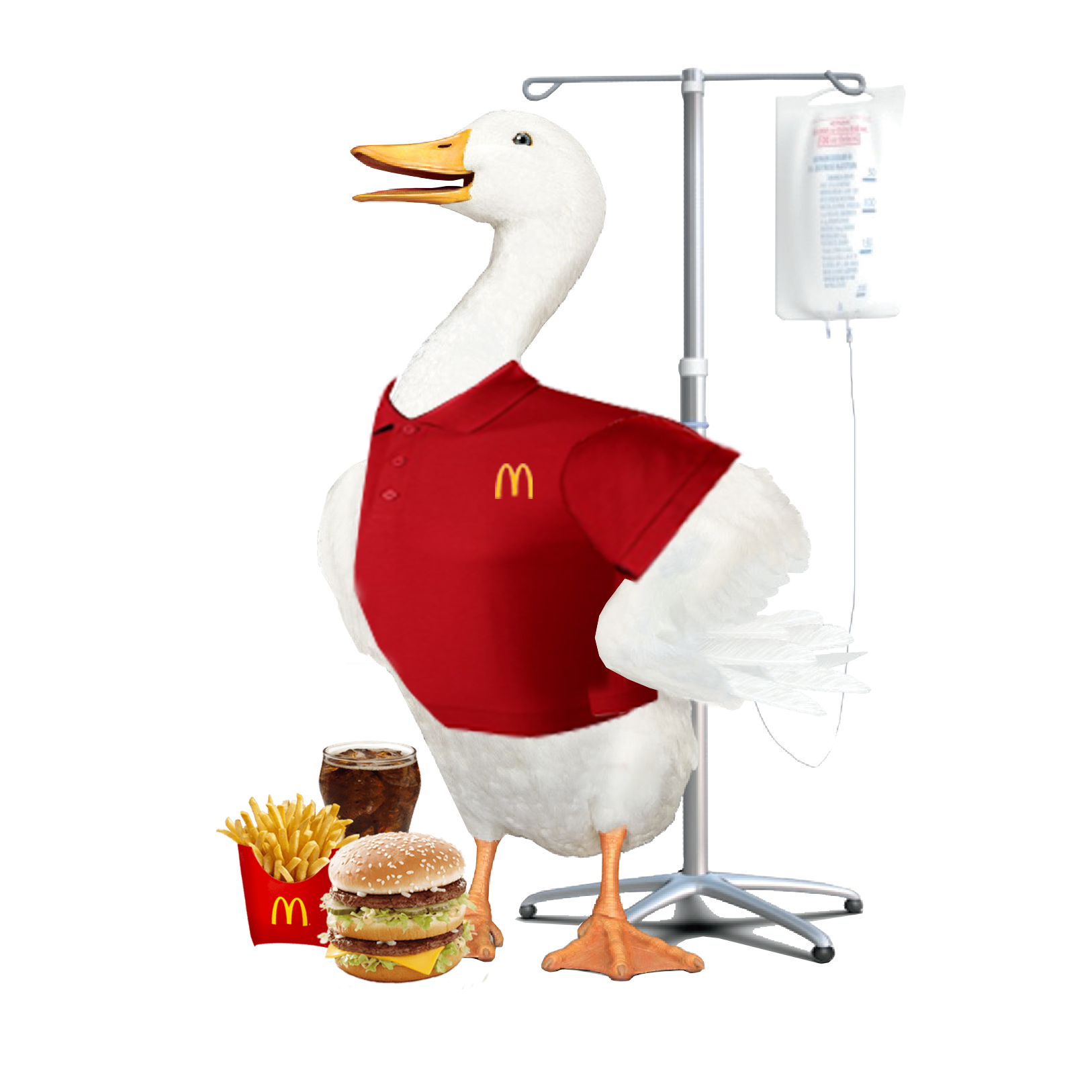

Group Accident Insurance

You can count on Aflac to help ease the financial stress of a specified disease, accident or hospital stay

No one plans on becoming injured. It’s just not something you typically think about.

When an accident occurs, there can be a great deal of treatment fees that exist outside of hospital bills. Aflac pays you cash benefits directly (unless assigned), which can be used to cover any out-of-pocket expenses - medical and nonmedical - associated with treatment in the event of a covered accident.

Features:

Accident Benefits

- ER/Urgent Care Initial Treatment Benefit

- Hospital Admission

- Inpatient/Outpatient Surgical and Anesthesia Benefits

- Lacerations, Fractures

- Appliances

Group Critical Illness Insurance

You can count on Aflac to help ease the financial stress of a specified disease, accident or hospital stay

Aflac New York Specified Disease insurance can help with the treatment costs of covered specified diseases, such as cancer, a heart attack, or a stroke. More importantly, the plan helps you focus on getting better (instead of the distraction and stress over the costs of medical and personal bills). This insurance gives you the flexibility to help pay bills related to treatment or to help with everyday living expenses.

Benefit amounts are available up to $50,000 for employees and up to $25,000 for spouses. Dependent children are covered at 50% of the employee’s amount at no additional charge.

Features:

Specified Disease Features

- There are no pre-existing condition limitations* (except cancer)

- The plan doesn’t have a waiting period for benefits.

- Guaranteed-issue coverage is available up to $30,000

- Rates are based on age at the time of application and do not individually increase due to a change in age, health, or individual claim.

Specified Disease Benefits

- Cancer (Internal or Invasive)

- Heart Attack

- Major Organ Failure

- End-Stage Kidney Disease

- Stroke

- Non-Invasive Cancer

- Coronary Artery Heart Disease

- Skin Cancer, once per calendar year $250

- Transient Ischemic Attack (TIA)

Group Hospital Insurance

You can count on Aflac to help ease the financial stress of a specified disease, accident or hospital stay

An unplanned hospital visit can leave you with expenses not covered by major medical. The Aflac Group Hospital Plan provides cash benefits directly to you (unless otherwise assigned) that help pay for some of the costs - medical and nonmedical - associated with a covered hospital stay due to a sickness or accidental injury.

Features:

Hospital Indemnity Features

- No pre-existing condition or pregnancy limitation

- Guaranteed Issue

Hospital Indemnity Benefits

- Hospital Admission Benefit

- Hospital Confinement Benefit